Jan 09, 2018

If you follow auto industry news, there is one topic that seems to be top-of-mind for automakers, suppliers and industry experts these days. The NAFTA negotiations have dominated headlines recently, as U.S. negotiators take a hard line position compared to previous discussions. There is concern that negotiations could break down entirely, ultimately ending a free trade agreement that has been in place for over two decades.

According to Fitch Ratings, Michigan is the state that would most likely suffer economic losses because of changes to NAFTA. This is not surprising as Michigan has significant economic ties to both Canada and Mexico, with 43 percent of our exports going to Canada and 22 percent to Mexico. Michigan also receives 36 percent of its imports from Canada and another 36 percent from Mexico.

Moreover, the strong presence of the automotive industry in Michigan means that any legislation or trade policy that adversely impacts the auto industry will undoubtedly impact our local economy. “Stricter trade regulations will change investment decisions,” explains Rob Luce, Executive Director of the Detroit Region Aerotropolis Development Corporation. “Those investment decisions are also job creation decisions.”

How NAFTA Impacts the Automotive Industry

The North American Free Trade Agreement, more commonly referred to as NAFTA, was signed in 1992. Its goal was to eliminate barriers to trade and investment between the United States, Canada and Mexico. Over the years, there have been many debates about the efficacy of the agreement, but most economists agree that NAFTA has been beneficial to the U.S. economy.

The automotive industry is at the heart of the ongoing NAFTA discussions. What is at stake for the automotive industry is the ability to optimize supply chains and effectively manage the cost of making vehicles. One of the current proposals on the table from the Trump Administration is to increase the percentage of regional content from 62.5 percent to 85 percent, along with an additional stipulation of 50 percent for U.S. content. This is not something that Canada or Mexico seem willing to accept, nor something that automakers could easily deliver – industry experts claim that U.S. content is currently hovering closer to 30 percent.

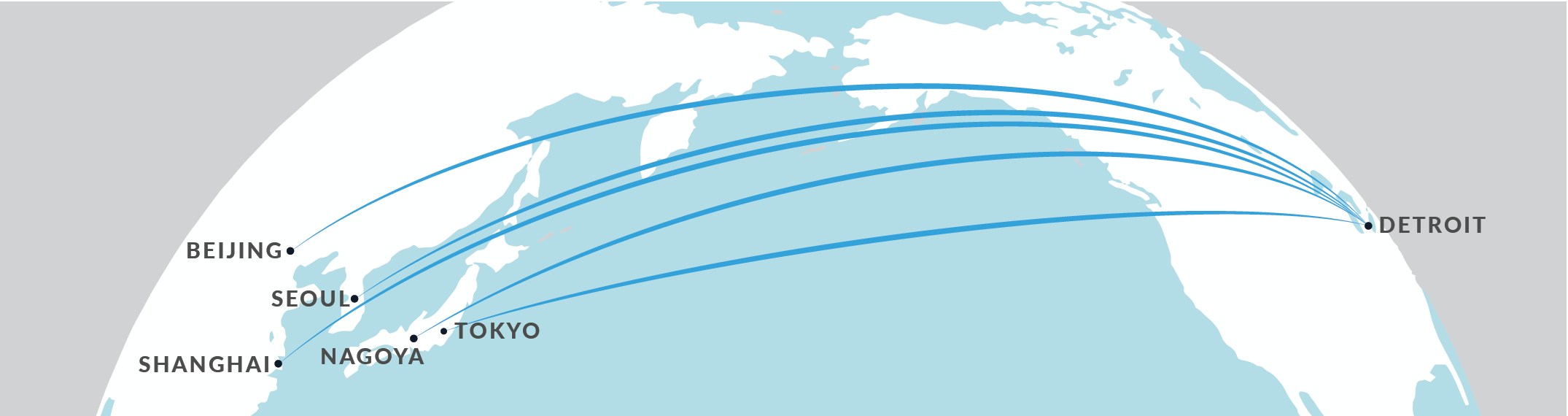

If automakers lose the trade benefits provided under NAFTA, it could equate to a $10 billion tax on the industry, and these taxes will hamper the growth that has taken place since the Great Recession. “The automotive industry operates in a global economy that extends beyond the borders of the United States, Canada and Mexico,” explains Luce. “If the changes to NAFTA are not favorable to automakers, or if the agreement breaks down completely, it could create an incentive for automakers and suppliers to shift production of parts to other countries with more favorable conditions.”

Loss of Jobs May Continue With or Without NAFTA

Job creation has been one of the most important themes of the NAFTA discussions, with the Trump Administration seeking to bring back manufacturing jobs to the United States. However, there is a much larger threat to manufacturing jobs than NAFTA. It turns out that automation is the primary culprit for the loss of manufacturing jobs in the United States. Of the 5.6 million manufacturing jobs lost from 2000 through 2010, approximately 85 percent of those jobs were lost due to automation, according to a study by the Center for Business and Economic Research at Ball State University. That means we may continue to experience job losses regardless of our trade policy. Experts predict that this trend will continue in the coming years, which presents its own challenges for our region.

What’s Next for NAFTA

Ultimately, what happens with NAFTA remains to be seen. Even if President Trump decides to walk away from the NAFTA negotiations, there are many legal scholars and lawmakers who believe that full withdrawal from NAFTA would require Congressional approval. Specifically, the repeal of the NAFTA Implementation Act, which is the piece of legislation that actually put NAFTA provisions into force by ending tariffs and taking other measures. Even if President Trump were able to technically withdraw from NAFTA, the agreement’s trade provisions would largely remain in force unless there was an act of Congress to change them.

If there is a dispute regarding presidential power it is likely that a lengthy court battle would ensue that could last for years, leaving the North American automotive industry in a precarious position. Withdrawal from NAFTA could also bring about a trade war, which would be damaging to the economies of all three countries.

“NAFTA is a complicated issue and there is no easy answer,” says Luce. “Regardless of what happens, there is likely to be some sort of backlash that will impact our region. We’ll just have to wait and see.”

Sources:

http://www.autonews.com/article/20171016/OEM/171019740/life-without-nafta-mexico-canada-suppliers

http://www.autonews.com/article/20171001/RETAIL01/171009986/auto-sales-decade-great-recession-10-years-later-car-truck

http://canada.autonews.com/article/20171002/CANADA/170929760/the-new-look-of-north-american-auto-production:-efficiency-is-up

http://www.freep.com/story/opinion/contributors/2017/11/03/nafta-trump-canada/825898001/

http://www.detroitnews.com/story/business/autos/2017/08/30/michigan-risk-nafta-renegotiations/105121040/

https://www.fitchratings.com/site/uspf/trade-in-time-of-trump