Jun 21, 2019

Michigan is a hotbed for global trade, exporting $59.8 billion worth of goods worldwide in 2017. Our shared border with Canada makes southeast Michigan an especially attractive location for companies seeking to expand their global footprint. Canada is Michigan’s largest trading partner with $24.8 billion in exports, followed by Mexico with $12.5 billion in exports. Over 14,600 companies exported goods from Michigan locations in 2015.

One of the ways companies can boost their global reach and increase operational efficiency is by partnering with or becoming a Foreign-Trade Zone (FTZ). The Foreign-Trade Zone program was designed to stimulate economic growth and development by encouraging companies to maintain and expand their operations in the United States.

“Foreign trade zones are one of a wide range of incentives for companies to locate here in the Detroit Aerotropolis Region,” explains Marco Salomone, Interim Executive Director of the Detroit Region Aerotropolis Development Corporation. “Companies whose business model involves importing raw materials or exporting finished goods around the world can achieve significant cost savings.”

What is a Foreign Trade Zone?

A Foreign-Trade Zone is a secure geographic area that is under the supervision of U.S. Customs and Border Protection. Within the defined boundaries of an FTZ, all domestic and foreign goods receive the same treatment by U.S. Customs as if they were held outside of the United States. Foreign-Trade Zones are commonly located in or around ports of entry, such as the Detroit/Windsor border. They are what most other countries refer to as free-trade zones.

Foreign-Trade Zones have been in place since 1934 and they have expanded rapidly in recent years. In 1970, there were 16 FTZs in the United States. Today, there are nearly 300 FTZs. Michigan has seven Foreign-Trade Zones, including the Greater Detroit Foreign-Trade Zone (GDFTZ), which is a key partner for companies that operate in the Aerotropolis Region.

FTZs can be operated by public or private entities. The Greater Detroit Foreign-Trade Zone is a non-profit Michigan corporation that has been in operation since the early 1980s. It serves as the grantee of Foreign-Trade Zone No. 70 under the authority of the U.S. Commerce Department’s Foreign-Trade Zones Board. As a public, non-profit entity without any political affiliation, the GDFTZ is a neutral third party that oversees the Foreign-Trade Zone program in our region.

What are the Benefits of Foreign Trade Zones?

Utilizing a Foreign-Trade Zone allows companies to avoid paying duties on raw materials and finished products shipped in or out of the United States. Normally, when foreign cargo is brought into the United States it needs to be cleared through customs and the company receiving the goods needs to pay U.S. Customs duties immediately. When foreign cargo is brought into a Foreign-Trade Zone, the company does not need to pay duties at the time the goods are received.

The FTZ program levels the playing field and encourages companies to maintain manufacturing operations in the United States. Instead of paying higher duties on parts, materials, or components that are imported for use in a manufacturing process, the company can pay the same tariffs as if the product had been manufactured abroad.

Here is a summary of the key benefits of utilizing a Foreign-Trade Zone:

- While in the zone, merchandise is not subject to U.S. duty or excise tax. These taxes are paid when the merchandise is transferred out of the FTZ for consumption.

- Depending upon what activities take place in the FTZ, the company may choose to pay the duty rate applicable to the foreign goods that were brought into the zone or the rate applicable to the finished product, whichever is more advantageous.

- Goods may be exported from the FTZ free of duty and excise tax.

- Merchandise may remain in a zone indefinitely, whether or not it is subject to duty. Materials can also be transferred from one FTZ to another while still avoiding payment of duties.

- Companies utilizing an FTZ can save on administrative paperwork and filing fees with U.S. Customs, since the FTZ only requires a single weekly entry instead of one entry per shipment.

- U.S. Customs and Border Patrol security requirements provide protection against theft.

What Activities Can Take Place in a Foreign Trade Zone?

There is a great deal of flexibility in the activities that can take place within a Foreign-Trade Zone. Companies can engage in assembly, manufacturing, processing, repackaging, repairing, and storing of materials, just to name a few. The activities must be approved by the FTZ Board. There are also limitations on the types of materials that can enter a zone. Generally speaking, any materials that are prohibited by law in the United States are also prohibited in a Foreign-Trade Zone.

Many types of companies can utilize a Foreign-Trade Zone to gain a competitive advantage, including:

- Automotive Manufacturing and Assembly

- Electronics Manufacturing

- General Manufacturing

- Pharmaceutical Manufacturing

- Food Processing

- Warehousing and Distribution

Foreign-Trade Zones are divided into two categories: General-Purpose Zones and Subzones. General-Purpose Zones are usually located in a large industrial park or warehouse complex. The facilities are available for use by any company who can gain approval from the FTZ Board. Subzones are normally single-purpose sites that are set aside for detailed or complex operations that cannot be handled in the General-Purpose Zone.

“Depending on the types of activities the company wants to perform, it may make sense to create a Subzone,” says Salomone. “The Aerotropolis can offer guidance and direct companies to experts who can walk them through the process.”

The Aerotropolis Region Attracts Global Companies

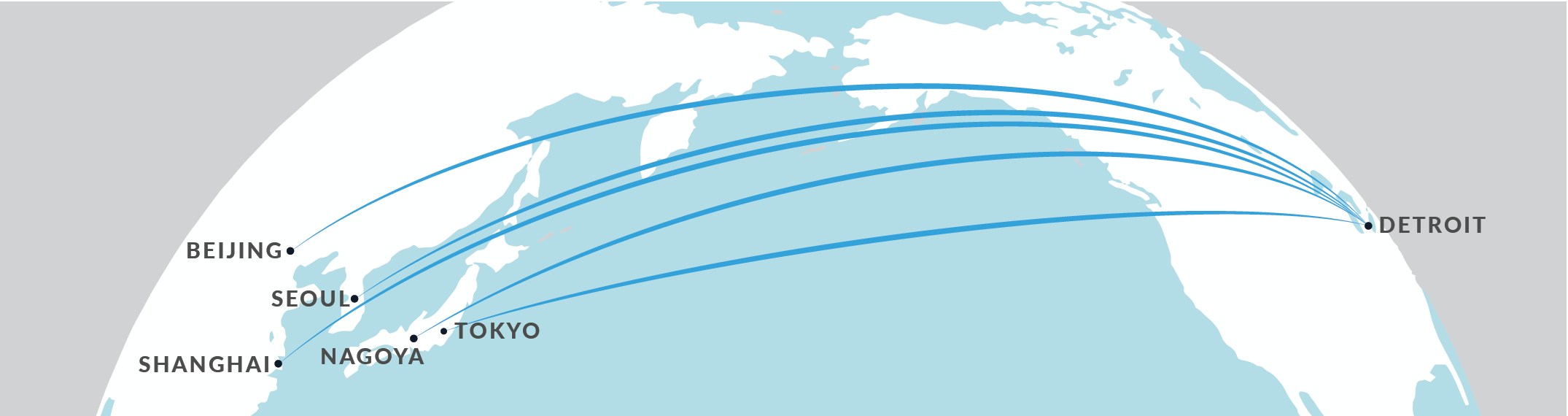

The Detroit Aerotropolis Region is the ideal location for companies seeking to take advantage of the benefits of Foreign-Trade Zones. The region is adjacent to the Detroit/Windsor border, which is the second busiest border crossing in the United States and processes over 25% of all merchandise trade between the United States and Canada. There is no shortage of opportunity for companies who decide to set up operations in the region.

“We operate in a global marketplace,” explains Salomone. “Businesses seeking to locate in our region want to know that they have easy access to import and export raw materials and finished products around the world. Providing infrastructure for global trade is part of the Aerotropolis Advantage.”

The Aerotropolis has a variety of investment properties available, including vacant lots and existing facilities. Our website is up to date with the latest listings for developers and investors to consider.

Sources:

https://www.inboundlogistics.com/cms/article/the-benefits-of-using-a-foreign-trade-zone/

https://www.uschamber.com/international/international-policy/benefits-international-trade

https://www.trade.gov/mas/ian/statereports/states/mi.pdf

https://www.michiganbusiness.org/49c990/globalassets/documents/reports/fact-sheets/ftzs.pdf